Gifts and Inheritance – Things NRIs Must Know

- nrigrow@gmail.com

- 0

- Posted on

Non-Resident Indians (NRIs) often receive gifts and inheritance assets from loved ones in India. While these acts stem from love and tradition, they carry legal and tax implications that should not be ignored. Understanding the Foreign Exchange Management Act (FEMA) and the Income Tax Act (IT Act), as well as associated compliance procedures, is crucial to avoid unnecessary penalties. From receiving money and property to selling inherited assets, the regulations differ based on the nature of the asset, the relationship with the giver, and the country of residence. This blog provides a comprehensive guide on gifts and inheritance for NRIs.

1. Understanding Gifts under Indian Law

Any money or asset received without consideration is considered a gift under the Income Tax Act. It may consist of:

- Cash or bank transfers

- Immovable property (like a flat, land)

- Movable assets (jewellery, art, shares, etc.)

Depending on the giver and the recipient, gifting is governed by both the Income Tax Act and the Foreign Exchange Management Act (FEMA).

2. Can an NRI Receive a Gift? – Eligibility & Tax Implications Table

Here’s a simplified decision table to determine the taxability of gifts and inheritance received by NRIs:

| Step | Question | Yes Outcome | No Outcome |

| 1 | Is the giver a relative (as per the Income Tax Act)? | Tax-free | Go to Step 2 |

| 2 | Is the total value of gifts in the year ≤ ₹50,000? | Tax-free | The entire amount is taxable |

| 3 | Is the asset permitted under FEMA (e.g., no agricultural land from residents)? | Proceed | Cannot be accepted |

| 4 | Is the transaction documented (proof of relationship & purpose available)? | Safe | Risk of scrutiny |

3. Gifts Permissibility for NRIs

| Asset Type | From a Resident Indian | From Another NRI/OCI |

| Cash (INR) | Permitted (Relatives only) | Not allowed to be credited to NRO |

| Foreign Currency | Permitted under LRS (Liberalised Remittance Scheme) limits – up to USD 250,000 per financial year | No upper limit |

| Residential/Commercial Property | Permitted (Non-agri only) | Permitted (Relatives only) |

| Agricultural Land/Farmhouse | Not permitted | Not permitted |

| Shares & Securities | Prior RBI approval is needed | Up to 5% of the issued capital allowed |

| Jewellery/Artworks | Under LRS limits | No restrictions under FEMA |

Note: Requires prior RBI approval (if from a resident)

Up to 5% of issued capital allowed (if from another NRI/OCI)

4. Taxation on Gifts

- Gifts from Relatives (as defined by the IT Act): Always tax-free

- Gifts on special occasions: Marriage, Will, contemplation of death – All are tax-free

- From Non-relatives:

- If ≤ ₹50,000: Tax-free

- If > ₹50,000: Entire amount taxable

Illustration Explained – How Gifts Become Taxable for NRIs

Let’s take the case of Malvika, an NRI who receives the following gifts during the financial year:

- ₹30,000 in cash from a friend

- ₹25,000 in cash from another friend

- An artwork worth ₹70,000 from a friend

Now, let’s break it down:

a. Cash Gifts

- Total cash = ₹30,000 + ₹25,000 = ₹55,000

- Since Malvika received this amount from non-relatives, and the total exceeds the ₹50,000 annual exemption limit, the entire ₹55,000 becomes taxable, not just the excess ₹5,000.

b. Gift of Artwork

- The fair market value (FMV) of the artwork = ₹70,000

- As this is also from a non-relative and its value exceeds ₹50,000, the entire ₹70,000 is taxable.

Final Taxable Amount:

- Cash: ₹55,000

- Artwork: ₹70,000

- Total Taxable Gift Income = ₹1,25,000

5. Receiving Inherited Property

Inheritance is not taxable in India, but documentation and compliance are crucial.

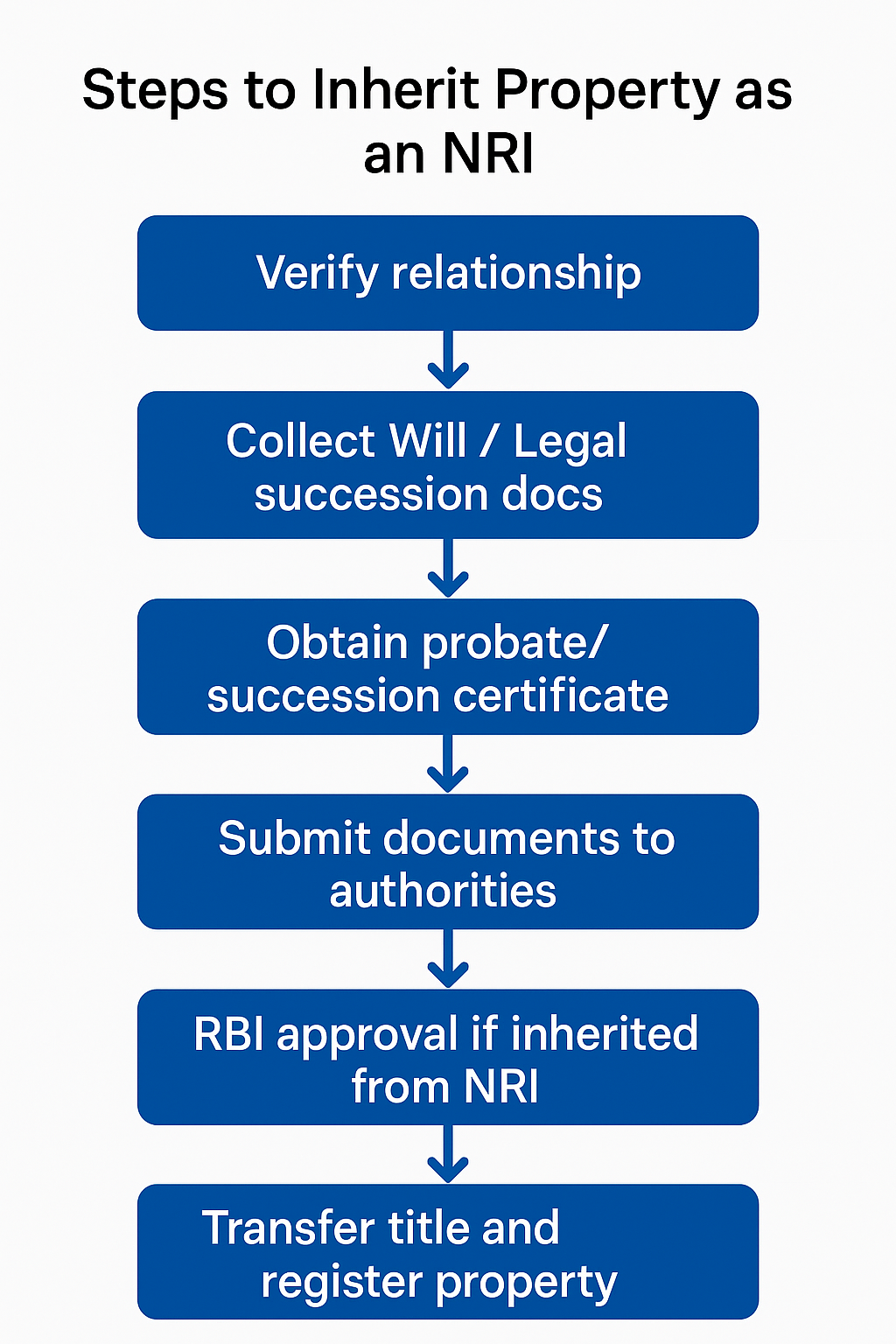

Flowchart: Steps to Inherit Property as an NRI

- Verify relationship

- Collect Will / Legal succession docs

- Obtain probate/succession certificate

- Submit documents to the authorities

- RBI approval is inherited from the NRI

- Transfer title and register property

6. Repatriation of Inherited Assets

| Criteria | Repatriation Allowed? |

| Property inherited from an Indian resident | Yes, up to USD 1 million/year |

| Property inherited from another NRI | Only with prior RBI approval |

| Agricultural land, farmhouses, etc. | Not allowed |

All sale proceeds must first be credited to the NRO account. Repatriation must follow FEMA and RBI procedures.

7. Tax on Income from Gifted or Inherited Assets

| Asset Type | Tax Implication |

| Rented Property | Tax on rental income (after municipal taxes & standard deduction) |

| Shares & FDs | Taxed as income from other sources |

| To minor/spouse | Income is taxed in the hands of the donor |

8. Sale of Gifted Assets & Capital Gains

- Immovable property: The Holding period of the donor is considered. Long-term if > 24 months

- Shares/securities: Long-term if held > 12 months (with STT paid)

- Other assets: Long-term if held > 36 months

- Capital Gains on Sale of Gifted Assets

| Asset | Long-Term Holding Period | Special Notes |

| Property | > 24 months | Use the cost & holding of the previous owner |

| Listed shares | > 12 months | FMV used if from a non-relative |

| Unlisted shares, others | > 36 months | FMV as on the date of receipt, or cost as on April 1, 2001, whichever is applicable |

- Capital gain = Sale price – Indexed cost of acquisition

Conclusion

For NRIs, receiving gifts and inheritance assets from India involves more than sentimental value. Legal, tax, and FEMA compliance are essential. Whether you’re receiving money, property, or artwork, always document, declare, and consult a tax expert to stay compliant in both India and your country of residence.

Gifting rules confusing? Let NRI Grow guide you with clarity on FEMA, taxation, and RBI norms—no guesswork, just solutions. From legal paperwork to tax planning, NRI Grow handles every step of your inheritance journey with precision and care.